Pilenowator Ai supports intending investment learners by connecting them with investment education firms online. These firms are formal institutions where people undergo thorough investment learning and are tested/certified. They share intensive investment knowledge that is not available on search engines.

Through investment academies, people learn the nitty-gritty of investment, develop the confidence to explain investment or financial concepts, and understand how the investment industry operates. Pilenowator Ai prepares people for these by sharing introductory investment concepts.

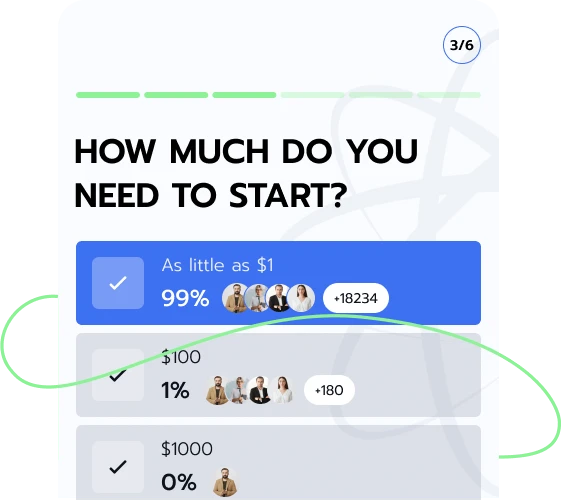

Connecting with investment academies on Pilenowator Ai is free. Anyone interested should click the registration button and provide a name, email address, and phone number. Each academy will assign a representative to their match on Pilenowator Ai to complete their registration.

Despite being populated with diverse information, people often cannot locate investment education firms online. Most investment-related companies on the internet focus solely on getting people to invest. With Pilenowator Ai’s help, people can connect directly with firms focused on raising investment-learned people, saving time and stress. Connect with such a firm on Pilenowator Ai.

People ready to connect with investment educators should register on Pilenowator Ai.

The registration process is free. All that Pilenowator Ai requires during registration is people’s names, emails, and phone numbers. Register for free on Pilenowator Ai to connect.

Once Pilenowator Ai registers and connects people, investment education firms set up their accounts on their (firms’) websites, considering their investment course choice.

Learners can choose courses based on their financial capacities. There’s something for everyone. Sign up on Pilenowator Ai to connect and start learning.

Registering and connecting with investment tutors is easy as the Pilenowator Ai website is accessible on all devices.

Pilenowator Ai is open round the clock for anyone. It is not time-zone-selective, allowing people from different regions, countries, or states to use it.

Connection with investment education firms is certain and done immediately.after registration on Pilenowator Ai. Register on Pilenowator Ai for an easy start toward financial enlightenment.

Investment education firms are formal institutions of learning dedicated to investment courses. The institutions also extend their scope to other financial disciplines to expand people’s knowledge further and build their financial, research, and problem-solving skills.

Teachers in these firms are skilled in sharing investment knowledge with learners. As teachers carry out their duties, they gauge learners’ understanding frequently. Register on Pilenowator Ai to connect with an investment education firm.

It is buying and holding an asset for future sale and possible gains. Investors buy assets based on their financial goals, demand, market conditions, time horizon, and risk tolerance. While investors adopt different strategies or techniques to target maximum returns, risks are the reasons success isn’t guaranteed. Pilenowator Ai points out key things to note about investing;

An asset class is a group of securities with similar characteristics, risks, and operations. Examples are bonds, cash/cash equivalents, stocks, commodities, and alternatives. Bonds include municipal, government, and corporate bonds, while cash/cash equivalents include money market funds, commercial papers, and currency. The stock asset class includes penny, growth, and income stocks. Learn more about asset classes by signing up on Pilenowator Ai.

These are marketplaces for securities. These exchanges may aid economic efficiency, capital raising, and corporate governance. Stock exchanges facilitate economic efficiency through stock allocation and liquidity. Companies can raise capital by issuing initial public offerings (IPOs). Regarding corporate governance, stock exchanges allow companies to adhere to regulatory bodies. Register on Pilenowator Ai to learn much more.

Risks

These affect investment negatively, causing full or partial losses. Types of risks are credit, business, reinvestment, and interest rate risks. Sign up on Pilenowator Ai for more information.

Investors

These entities buy assets or loan money to businesses for possible capital gains. Learn the types of investors by connecting with an investment teacher on Pilenowator Ai.

Investment Strategies

Investors strategize to select investments based on certain factors and to mitigate risks.

Common investment strategies include value, buy-and-hold, growth, momentum, dollar-cost averaging investing, diversification, and asset allocation. Value investing is buying undervalued stocks and reselling if the value increases. Buy-and-hold investing involves purchasing assets and holding despite favorable short-term market conditions. To learn more, sign up on Pilenowator Ai.

It signifies the level of risk an investor can bear. Age, time horizon, and investment goals contribute to people’s risk tolerance, while market swings, economic and political events, interest rate fluctuations, and stock volatility can affect their risk tolerance. Risk tolerance can be moderate, conservative, or aggressive. Get detailed information about the risk tolerance types from investment education firms by registering on Pilenowator Ai.

Financial literacy is understanding and being skilled in different financial disciplines such as saving, investing, budgeting, financial planning, and debt management. People obtain financial literacy through podcasts, books, free videos, and following investment teachers. Pilenowator Ai wants people to achieve financial literacy by connecting them with investment education companies.

Through this connection, people can easily access thorough teachings and materials that will contribute to their financial literacy. As people gain financial literacy with Pilenowator Ai’s help, they may identify financial mistakes, extravagant spending, and incorrect financial/investment content shared by supposed financial gurus over the internet.

By learning from investment teachers accessible via Pilenowator Ai, one can gain a broader understanding of the strategies investors employ and certain skills. These skills include self-payment, paying bills on time, creating a budget, debt management, and checking credit scores. Learn more about investment education companies on Pilenowator Ai.

Companies use depreciation to spread a physical asset cost over its useful life. Depreciation shows how much an asset’s value is depleted. Companies use depreciation for tax and financial reporting purposes. For tax purposes, businesses may use depreciation to reduce taxable income, thereby reducing tax liability.

Assets depreciated for financial purposes are considered non-charge as they do not represent an actual cash flow. Types of depreciation methods are straight line, double declining balance, units of production, and the sum-of-the-years digits. Pilenowator Ai explains them below;

In this depreciation method, the expense amount remains constant yearly throughout the useful life of an asset. Businesses use the straight-line method to calculate depreciation by dividing the difference between cost and salvage value by an asset’s useful life. Learn more about straight-line depreciation by signing up on Pilenowator Ai.

This depreciation method shows that assets may be more productive in their early years than in later years. The depreciation factor of this method is twice that of the single-line depreciation method. The rate of depreciation is calculated as (100% ÷ useful life of an asset) x 2, while the periodic depreciation expense is expressed as beginning book value x rate of depreciation. Register on Pilenowator Ai to learn more.

The units of production method depreciate an asset based on the duration of use or the number of units to produce by using the asset over its useful life. Depreciation expense is calculated with this formula: (number of units produced ÷ life in number of units) x (cost – salvage value). Get more information by signing up on Pilenowator Ai.

The SYD method is an accelerated depreciation method. In this method, a higher expense is incurred on an asset in the early years, while a lower expense is incurred in the later years of an asset’s useful life. The depreciation base of an asset is calculated as cost - salvage value, while the depreciation expense is expressed as (remaining life ÷ sum of the years digits) x (cost – salvage value). For a more detailed explanation, register on Pilenowator Ai to connect with investment teachers.

Bond pricing is calculating a bond issue price. Characteristics considered for pricing are coupon, principal/par value, yield to maturity, and periods to maturity. A coupon is the nominal percentage of a bond’s principal amount/par value. Some bonds are zero-coupon as they do not come with coupons but guarantee principal at maturity.

A bond has a principal value that an issuer repays to a lender at maturity. Bonds are priced to yield certain amounts. Bonds sold above par value may have a yield to maturity lower than the coupon rate. Also, a bond can be sold higher if the coupon rate exceeds the expected yield. To learn more, register on Pilenowator Ai.

A bond ladder is a strategy for creating a portfolio with fixed-income securities and bonds that mature at close intervals.

Investors use this strategy to seek higher average yields and reduce liquidity and interest rate risks. While creating the portfolio, investors decide how much and how long to invest and determine assets’ maturity intervals.

This strategy has advantages but involves paying fees and engaging in multiple transactions. It can also force investors to invest in lower interest rates based on interest rate movement when a bond expires. Sign up on Pilenowator Ai to learn more about this strategy from investment teachers.

This investment strategy has one buying long-term and short-term bonds only. The strategy may allow investors to access higher-yield long-term bonds. Despite this, bonds are still prone to interest rate risk, and investors cannot invest in intermediate-term bonds. Register on Pilenowator Ai for more information.

An idle cash is a fund not used to increase a business’ value. It can also be deposited in an account without accruing interest. Register on Pilenowator Ai for more information.

A savings account is an account for holding unneeded money. Sign up on Pilenowator Ai for more.

A checking account is a deposit account that allows withdrawals for everyday transactions. Want to know more? Register on Pilenowator Ai.

A cash flow is a business or a project’s inward and outward cash movement. Register on Pilenowator Ai for more.

Financial modeling combines business metrics, accounting, and finance to forecast a company’s future results. Learn more about the uses of financial modeling from investment teachers by registering on Pilenowator Ai.

This financial modeling tool analyzes how the different sets of values of independent variables affect a certain dependent variable. Learn more on Pilenowator Ai.

Many people have put investment education on the back burner these days. They seem to favor jumping on the next hot stock or crypto bandwagon, but there’s much more to investing.

Pilenowator Ai is open to anyone interested in acquiring investment knowledge to make informed decisions. Register on Pilenowator Ai and connect with investment education companies.

| 🤖 Registration Cost | Free |

| 💰 Fees | No Fees |

| 📋 Registration | Simple, quick |

| 📊 Education Focus | Cryptocurrencies, Forex, Mutual Funds, and Other Investments |

| 🌎 Supported Countries | Most countries Except USA |